A complete list of Company stockholders entitled to vote at the Annual Meeting will be available at our principal executive offices during normal business hours, at least 10 days prior to the Annual Meeting and during the Annual Meeting at www.virtualshareholdermeeting.com/ABEO2022. According to our Bylaws, the presence, through virtual attendance or by proxy, of the holders of a majority of the shares of Common Stock outstanding and entitled to vote constitutes a quorum for the conduct of business at the Annual Meeting. Abstentions and broker non-votes are counted as present for purposes of determining whether a quorum is present.

A broker non-vote occurs when brokers, who hold their clients’ shares in street name, sign and submit proxies for such shares and vote such shares on some matters but not others. This would occur when brokers have not received any instructions from their clients, in which case the brokers, as the holders of record, are permitted to vote on “routine” matters, which include the ratification of the appointment of an independent registered public accounting firm, but not on “non-routine” matters, such as the election of directors and the amendment to the Abeona Therapeutics Inc. 2015 Equity Incentive Plan.

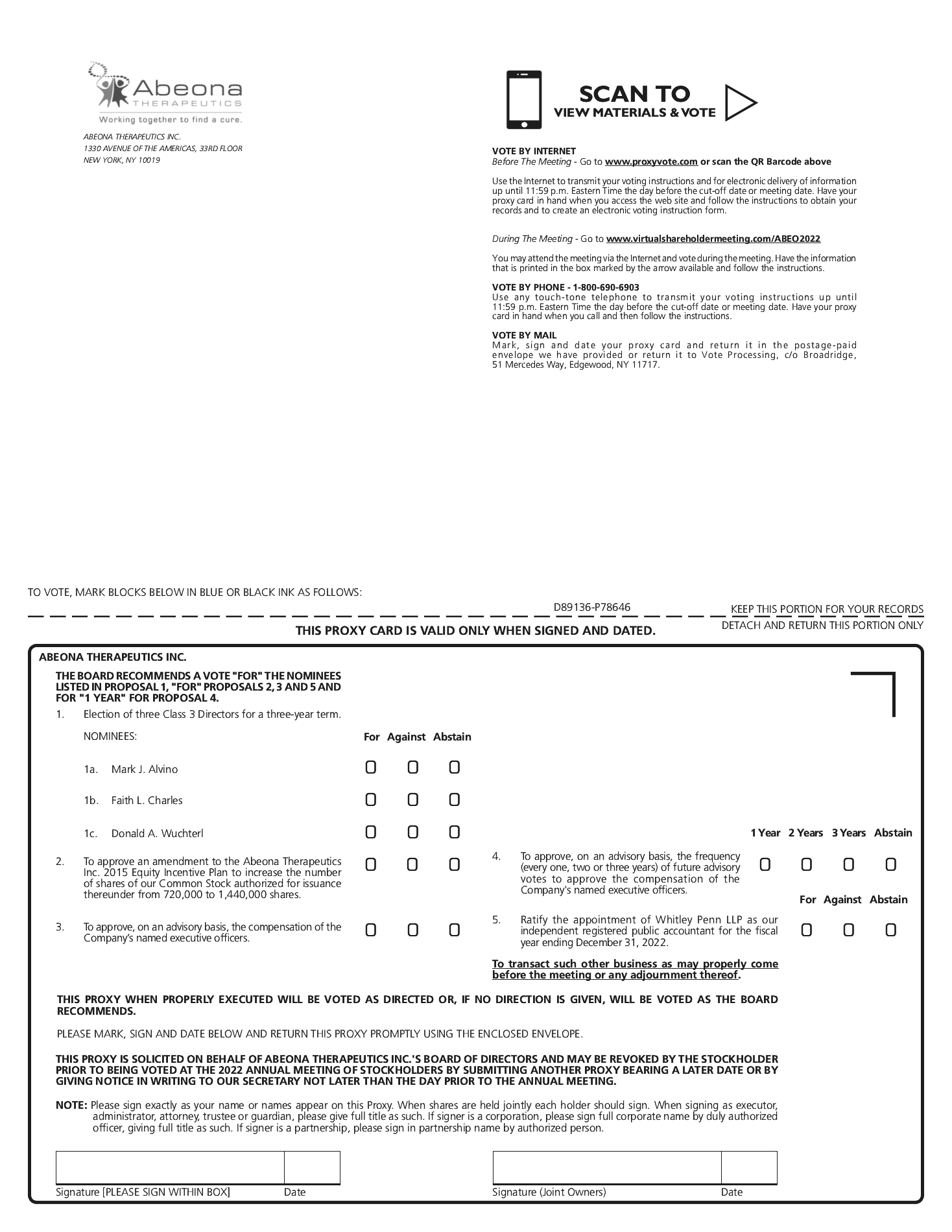

For Proposal 1, the directors will be elected upon the affirmative vote of a majority of the votes cast. For Proposal 1, stockholders may vote “FOR,” “AGAINST,” or “ABSTAIN.” Abstentions and broker non-votes will have no effect on Proposal 1.

Proposals 2 and 3 each will be approved upon the affirmative vote of a majority of the outstanding shares of Common Stock present through virtual attendance or by proxy at the Annual Meeting and entitled to vote on the respective Proposal. Stockholders may vote “FOR” or “AGAINST,” or “ABSTAIN” from voting. Abstentions we have effect of a vote “AGAINST” each of Proposals 2 and 3, respectively. Broker non-votes, if any, will be disregarded and will have no effect on the outcome of the votes for Proposals 2 and 3.

For Proposal 4, the preferred frequency of advisory votes on executive compensation will be approved, on an advisory basis, based upon which option receives the highest number of votes cast by stockholders. Stockholders may vote “1 YEAR,” “2 YEARS,” “3 YEARS” or “ABSTAIN” on the proposal to approve, on an advisory basis, the preferred frequency of advisory votes on executive compensation. Abstentions and broker non-votes will have no effect on Proposal 4.

Proposal 5, ratification of Whitley Penn LLP as our independent public accountant, will be approved upon the affirmative vote of a majority of the outstanding shares of Common Stock voting present through virtual attendance or by proxy at the Annual Meeting. Abstentions will have the effect of a vote “AGAINST” such proposal. Brokers may vote on Proposal 5 absent instructions from the beneficial owner.

The Board is not aware of any matters that will be brought before the Annual Meeting other than those matters specifically set forth in the Notice of Annual Meeting. However, if any other matter properly comes before the Annual Meeting, it is intended that the persons named in the enclosed form of proxy, or their substitutes acting thereunder, will vote on such matter in accordance with the recommendations of the Board, or, if no such recommendations are made, in accordance with their best judgment.

All expenses in connection with solicitation of proxies will be borne by us. We will also request brokers, dealers, banks and voting trustees, and their nominees, to make available the Notice of Annual Meeting, this proxy statement, the accompanying form of proxy and our annual report on Form 10-K for the fiscal year ended December 31, 2021 (the “Annual Report”) to beneficial owners and will reimburse them for their expenses in forwarding these materials. We expect to solicit proxies primarily by mail, but our directors, officers and employees may also solicit in person, by telephone or email.

Stockholders of record as of the Record Date can attend the Annual Meeting online by logging onto our virtual forum at www.virtualshareholdermeeting.com/ABEO2022 and following the instructions provided on their proxy card or vote instruction card. To participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or voter instruction card. If you do not have this control number at the time of the Annual Meeting, you will still be able to attend virtually, but you will not be able to vote or ask questions.

The virtual Annual Meeting platform is fully supported across browsers (Microsoft Edge, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Attendees should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the virtual Annual Meeting. Attendees should also give themselves plenty of time to log in and ensure that they can hear streaming audio prior to the start of the virtual Annual Meeting.