UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(Mark one)

| [X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended March 31, 2020 | |

or | |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-15771

ABEONA THERAPEUTICS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 83-0221517 | |

| (State or other jurisdiction of | (I.R.S. Employer I.D. No.) | |

| incorporation or organization) |

1330 Avenue of the Americas, 33rd Floor, New York, NY 10019

(Address of principal executive offices, zip code)

(646) 813-4701

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.01 par value | ABEO | Nasdaq Capital Market |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [X] | |

| Non-accelerated filer [ ] | Smaller reporting company [X] | |

Emerging growth company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The number of shares outstanding of the registrant’s common stock as of May 1, 2020 was 83,697,928 shares.

ABEONA THERAPEUTICS INC.

INDEX

| 2 |

FORWARD-LOOKING STATEMENTS

This Form 10-Q contains statements that express management’s opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “could,” “would,” “seeks,” “estimates,” and variations of such words and similar expressions, and the negatives thereof, are intended to identify such forward-looking statements. Such “forward-looking statements” speak only as of the date made and are not guarantees of future performance and involve certain risks, uncertainties, estimates, and assumptions by management that are difficult to predict. Various factors, some of which are beyond the Company’s control, could cause actual results to differ materially from those expressed in, or implied by, such forward-looking statements. In addition, we disclaim any obligation to update any forward-looking statements to reflect events or circumstances after the date of this report, except as may otherwise be required by the federal securities laws.

Forward-looking statements necessarily involve risks and uncertainties, and our actual results could differ materially from those anticipated in forward-looking statements due to a number of factors. These statements include statements about: the potential impacts of the COVID-19 pandemic on our business, operations, and financial condition; the achievement of or expected timing, progress and results of clinical development, clinical trials and potential regulatory approvals; our Phase III clinical trial (VIITAL™) for patients with recessive dystrophic epidermolysis bullosa (“RDEB”) and our beliefs relating thereto; our ability to identify and enroll patients in the Phase III clinical trial; our pipeline of product candidates; our belief that we have sufficient resources to fund operations for the next 12 months; the dilutive effect that raising additional funds by selling additional equity securities would have on the relative equity ownership of our existing investors; our belief that EB-101 could potentially benefit patients with RDEB; our belief that adeno-associated virus (“AAV”) treatment could potentially benefit patients with Sanfilippo syndrome type A (“MPS IIIA”) and Sanfilippo syndrome type B (“MPS IIIB”); our ability to develop our novel AAV-based gene therapy platform technology; our belief in the adequacy of the data from clinical trials, including trials in EB-101 and our Phase I/II clinical trial in ABO-102 (AAV-SGSH) for MPS IIIA, together with the data generated in the program to date, to support regulatory approvals; our dependence upon our third-party and related-party customers and vendors and their compliance with regulatory bodies; our intellectual property position and our ability to obtain, maintain and enforce intellectual property protection and exclusivity for our proprietary assets; our estimates regarding the size of the potential markets for our product candidates, the strength of our commercialization strategies and our ability to serve and supply those markets; and future economic conditions or performance.

Important factors that could affect performance and cause results to differ materially from management’s expectations are described in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Company’s Form 10-K for the fiscal year ended December 31, 2019, as updated from time to time in the Company’s Securities and Exchange Commission filings, including this Form 10-Q. These factors include: the impact of the COVID-19 pandemic on our business, operations (including our clinical trials), and financial condition, and on our ability to access the capital markets; our estimates regarding expenses, future revenues, capital requirements, and needs for additional financing; our ability to raise capital; our ability to fund our operating expenses and capital expenditure requirements for at least the next 12 months with our existing cash and cash equivalents; our ability to obtain additional equity funding from current or new stockholders, out-licensing technology and/or other assets, deferring and/or eliminating planned expenditures, restructuring operations and/or reducing headcount, and sales of assets; the dilutive effect that raising additional funds by selling additional equity securities would have on the relative equity ownership of our existing investors; our ability to continue to develop our novel AAV-based gene therapy platform technology; the outcome of any interactions with the U.S. Food and Drug Administration (“FDA”) or other regulatory agencies relating to any of our products or product candidates; our ability to execute a Phase III clinical trial for patients with RDEB; our ability to complete enrollment of patients into clinical trials to secure sufficient data to assess efficacy and safety; our ability to identify additional patients for our Phase I/II clinical trial for patients with MPS IIIA and MPS IIIB; our ability to continue to secure and maintain regulatory designations for our product candidates; our ability to develop manufacturing capability compliant with current good manufacturing practices for our product candidates; our ability to manufacture gene and cell therapy products and produce an adequate product supply to support clinical trials and potentially future commercialization; the rate and degree of market acceptance of our product candidates for any indication once approved; our ability to meet our obligations contained in license agreements to which we are party.

| 3 |

PART I – FINANCIAL INFORMATION

Abeona Therapeutics Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

March 31, 2020 | December 31, 2019 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 40,155,000 | $ | 129,258,000 | ||||

| Short-term investments | 75,887,000 | - | ||||||

| Prepaid expenses and other current assets | 2,716,000 | 3,132,000 | ||||||

| Total current assets | 118,758,000 | 132,390,000 | ||||||

| Property and equipment, net | 12,865,000 | 13,157,000 | ||||||

| Right-of-use lease assets | 7,802,000 | 8,047,000 | ||||||

| Licensed technology, net | 1,968,000 | 36,178,000 | ||||||

| Goodwill | 32,466,000 | 32,466,000 | ||||||

| Other assets and restricted cash | 1,144,000 | 1,144,000 | ||||||

| Total assets | $ | 175,003,000 | $ | 223,382,000 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 1,763,000 | $ | 3,763,000 | ||||

| Accrued expenses | 4,852,000 | 5,543,000 | ||||||

| Current portion of lease liability | 1,702,000 | 1,699,000 | ||||||

| Current portion of payable to licensor | 28,000,000 | 27,400,000 | ||||||

| Deferred revenue | 296,000 | 296,000 | ||||||

| Total current liabilities | 36,613,000 | 38,701,000 | ||||||

| Long-term lease liabilities | 6,013,000 | 6,251,000 | ||||||

| Total liabilities | 42,626,000 | 44,952,000 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders’ equity: | ||||||||

| Common stock - $0.01 par value; authorized 200,000,000 shares; issued and outstanding 83,622,135 at March 31, 2020 and December 31, 2019 | 836,000 | 836,000 | ||||||

| Additional paid-in capital | 665,784,000 | 664,064,000 | ||||||

| Accumulated deficit | (534,629,000 | ) | (486,470,000 | ) | ||||

| Accumulated other comprehensive income | 386,000 | - | ||||||

| Total stockholders’ equity | 132,377,000 | 178,430,000 | ||||||

| Total liabilities and stockholders’ equity | $ | 175,003,000 | $ | 223,382,000 | ||||

The accompanying notes are an integral part of these condensed consolidated statements.

| 4 |

Abeona Therapeutics Inc. and Subsidiaries

Condensed Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

| For the three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Revenues | $ | - | $ | - | ||||

| Expenses: | ||||||||

| Research and development | 6,818,000 | 11,737,000 | ||||||

| General and administrative | 6,412,000 | 5,659,000 | ||||||

| Depreciation and amortization | 2,065,000 | 1,658,000 | ||||||

| Licensed technology impairment charge | 32,916,000 | - | ||||||

| Total expenses | 48,211,000 | 19,054,000 | ||||||

| Loss from operations | (48,211,000 | ) | (19,054,000 | ) | ||||

| Interest and miscellaneous income | 652,000 | 499,000 | ||||||

| Interest expense | (600,000 | ) | - | |||||

| Net loss | $ | (48,159,000 | ) | $ | (18,555,000 | ) | ||

| Basic and diluted loss per common share | $ | (0.52 | ) | $ | (0.39 | ) | ||

| Weighted average number of common shares outstanding – basic and diluted | 92,639,190 | 47,948,421 | ||||||

| Other comprehensive income/(loss): | ||||||||

| Change in unrealized gains related to available-for-sale debt securities | 386,000 | - | ||||||

| Comprehensive loss | $ | (47,773,000 | ) | $ | (18,555,000 | ) | ||

The accompanying notes are an integral part of these condensed consolidated statements.

| 5 |

Abeona Therapeutics Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders’ Equity

(Unaudited)

| Accumulated | ||||||||||||||||||||||||

| Additional | Other | Total | ||||||||||||||||||||||

| Common Stock | Paid-in | Accumulated | Comprehensive | Stockholders’ | ||||||||||||||||||||

| Shares | Amount | Capital | Deficit | Income | Equity | |||||||||||||||||||

| Balance, December 31, 2018 | 47,944,486 | $ | 479,000 | $ | 543,754,000 | $ | (410,188,000 | ) | $ | - | $ | 134,045,000 | ||||||||||||

| Stock option-based compensation expense | - | - | 2,103,000 | - | - | 2,103,000 | ||||||||||||||||||

| Restricted stock-based compensation expense | - | - | 172,000 | - | - | 172,000 | ||||||||||||||||||

| Common stock issued for cash exercise of options | 5,208 | - | 28,000 | - | - | 28,000 | ||||||||||||||||||

| Net loss | - | - | - | (18,555,000 | ) | - | (18,555,000 | ) | ||||||||||||||||

| Balance, March 31, 2019 | 47,949,694 | $ | 479,000 | $ | 546,057,000 | $ | (428,743,000 | ) | $ | - | $ | 117,793,000 | ||||||||||||

| Balance, December 31, 2019 | 83,622,135 | $ | 836,000 | $ | 664,064,000 | $ | (486,470,000 | ) | $ | - | $ | 178,430,000 | ||||||||||||

| Stock option-based compensation expense | - | - | 1,256,000 | - | - | 1,256,000 | ||||||||||||||||||

| Restricted stock-based compensation expense | - | - | 464,000 | - | - | 464,000 | ||||||||||||||||||

| Net loss | - | - | - | (48,159,000 | ) | - | (48,159,000 | ) | ||||||||||||||||

| Other comprehensive income | - | - | - | - | 386,000 | 386,000 | ||||||||||||||||||

| Balance, March 31, 2020 | 83,622,135 | $ | 836,000 | $ | 665,784,000 | $ | (534,629,000 | ) | $ | 386,000 | $ | 132,377,000 | ||||||||||||

The accompanying notes are an integral part of these condensed consolidated statements.

| 6 |

Abeona Therapeutics Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| For the three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | (48,159,000 | ) | $ | (18,555,000 | ) | ||

| Adjustments to reconcile net loss to cash used in operating activities: | ||||||||

| Non-cash licensed technology impairment charge | 32,916,000 | - | ||||||

| Depreciation and amortization | 2,065,000 | 1,658,000 | ||||||

| Stock option-based compensation expense | 1,256,000 | 2,103,000 | ||||||

| Restricted stock-based compensation expense | 464,000 | 172,000 | ||||||

| Non-cash interest expense | 600,000 | - | ||||||

| Accretion and interest on short-term investments | (109,000 | ) | (169,000 | ) | ||||

| Accretion of right-of-use lease assets | 245,000 | 150,000 | ||||||

| Change in operating assets and liabilities: | ||||||||

| Receivables | - | 43,000 | ||||||

| Prepaid expenses and other current assets | 416,000 | 430,000 | ||||||

| Accounts payable, accrued expenses and lease liabilities | (2,926,000 | ) | (910,000 | ) | ||||

| Net cash used in operating activities | (13,232,000 | ) | (15,078,000 | ) | ||||

| Cash flows from investing activities: | ||||||||

| Capital expenditures | (479,000 | ) | (1,226,000 | ) | ||||

| Purchases of short-term investments | (75,392,000 | ) | - | |||||

| Proceeds from maturities of short-term investments | - | 24,000,000 | ||||||

| Net cash (used in) provided by investing activities | (75,871,000 | ) | 22,774,000 | |||||

| Cash flows from financing activities: | ||||||||

| Proceeds from exercise of stock options | - | 28,000 | ||||||

| Net cash provided by financing activities | - | 28,000 | ||||||

| Net (decrease) increase in cash, cash equivalents and restricted cash | (89,103,000 | ) | 7,724,000 | |||||

| Cash, cash equivalents and restricted cash at beginning of period | 130,368,000 | 19,310,000 | ||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 41,265,000 | $ | 27,034,000 | ||||

| Supplemental cash flow information: | ||||||||

| Cash and cash equivalents | $ | 40,155,000 | $ | 25,924,000 | ||||

| Restricted cash | 1,110,000 | 1,110,000 | ||||||

| Total cash, cash equivalents and restricted cash | $ | 41,265,000 | $ | 27,034,000 | ||||

| Cash paid for interest | $ | - | $ | - | ||||

The accompanying notes are an integral part of these condensed consolidated statements.

| 7 |

ABEONA THERAPEUTICS INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

(Unaudited)

NOTE 1 – NATURE OF OPERATIONS AND SIGNIFICANT ACCOUNTING POLICIES

Background

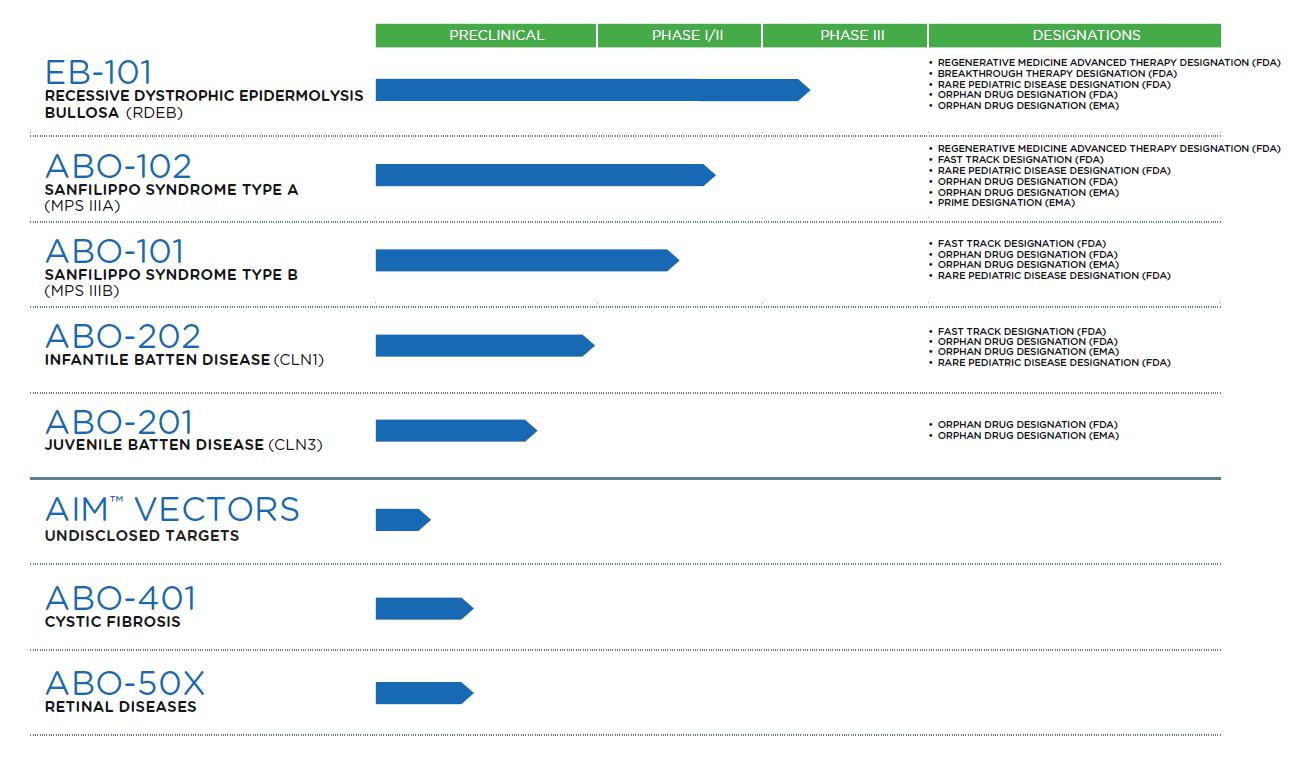

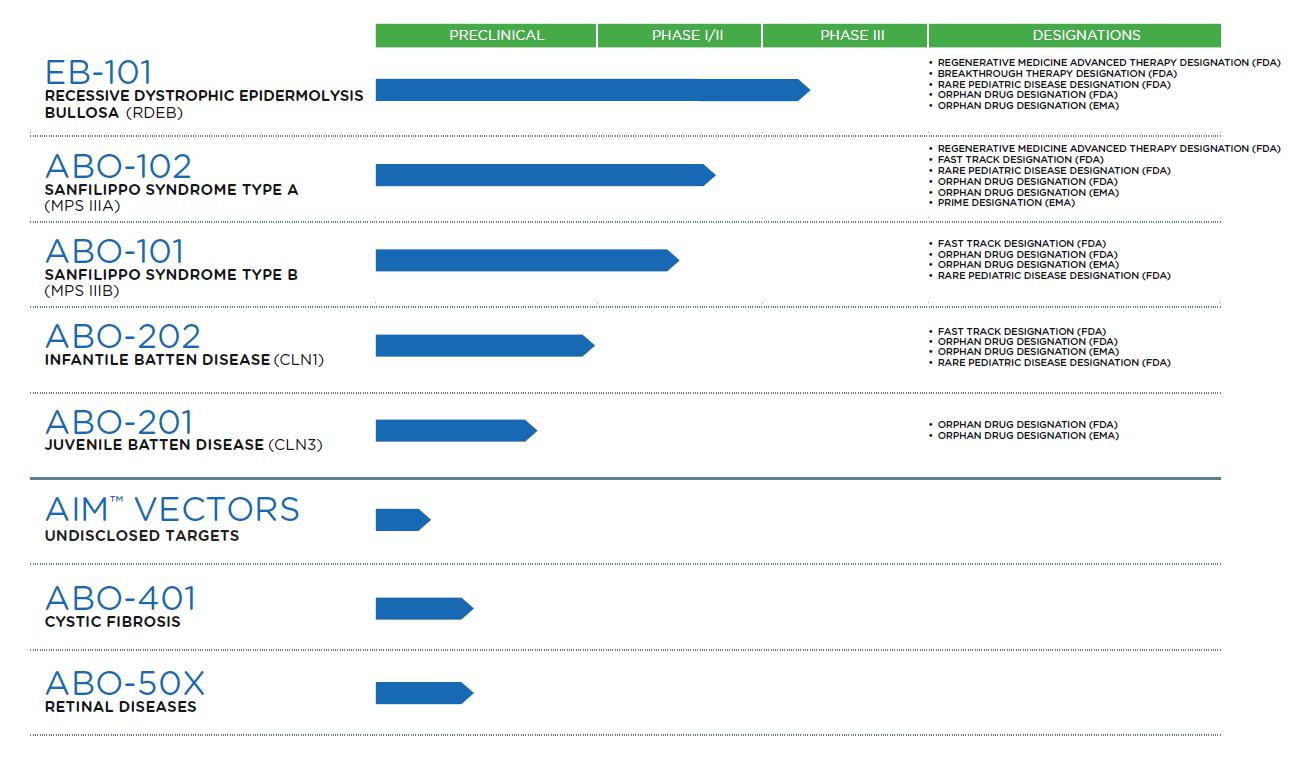

Abeona Therapeutics Inc., a Delaware corporation (together with our subsidiaries, “we,” “our,” “Abeona” or the “Company”), is a clinical-stage biopharmaceutical company developing gene and cell therapies for life-threatening rare genetic diseases. Our lead clinical programs consist of: (i) EB-101, an autologous, gene-corrected cell therapy for recessive dystrophic epidermolysis bullosa (“RDEB”), (ii) ABO-102, an adeno-associated virus (“AAV”)-based gene therapy for Sanfilippo syndrome type A (“MPS IIIA”), and (iii) ABO-101, an AAV-based gene therapy for Sanfilippo syndrome type B (“MPS IIIB”). We have additional AAV-based gene therapies in various developmental stages designed to treat the CLN1 and CLN3 forms of Batten Disease, cystic fibrosis and retinal diseases. In addition, we are developing next-generation AAV-based gene therapies using our novel AIM™ capsid platform and internal AAV vector research programs. Our efforts have been principally devoted to research and development, resulting in significant losses.

Basis of Presentation

The condensed consolidated balance sheet as of March 31, 2020 and the condensed consolidated statements of operations and comprehensive loss, stockholders’ equity and cash flows for the three months ended March 31, 2020 and 2019 were prepared by management without audit. In the opinion of management, all adjustments, consisting only of normal recurring adjustments, except as otherwise disclosed, necessary for the fair presentation of the financial position, results of operations, and changes in financial position for such periods, have been made.

Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) have been condensed or omitted. These interim financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in our Form 10-K for the year ended December 31, 2019. The results of operations for the period ended March 31, 2020 are not necessarily indicative of the operating results that may be expected for a full year. The condensed consolidated balance sheet as of December 31, 2019 contains financial information taken from the audited Abeona consolidated financial statements as of that date.

Uses and Sources of Liquidity

The financial statements have been prepared on the going concern basis, which assumes the Company will have sufficient cash to pay its operating expenses, as and when they become payable, for a period of at least 12 months from the date the financial report was issued.

As of March 31, 2020, we had cash, cash equivalents and short-term investments of $116.0 million and net assets of $132.4 million. For the three months ended March 31, 2020, we had cash outflows from operations of $13.2 million. We have not generated any significant product revenues and have not achieved profitable operations. There is no assurance that profitable operations will ever be achieved, and, if achieved, could be sustained on a continuing basis. In addition, development activities, clinical and nonclinical testing, and commercialization of our products will require significant additional financing.

We are subject to a number of risks similar to other life science companies, including, but not limited to, risks related to the successful discovery and development of product candidates, obtaining the necessary regulatory approval to market our product candidates, raising additional capital to continue to fund our operations, development of competing drugs and therapies, protection of proprietary technology and market acceptance of our products. As a result of these and other risks and the related uncertainties, there can be no assurance of our future success.

Based upon our current operating plans, we believe that we have sufficient resources to fund operations through the next 12 months with our existing cash and cash equivalents. We will need to secure additional funding in the future, to carry out all our planned research and development activities. If we are unable to obtain additional financing or generate license or product revenue, the lack of liquidity and sufficient capital resources could have a material adverse effect on our future prospects.

| 8 |

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make estimates and assumptions that affect the reported amount of assets and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reported period. Actual results could differ from these estimates and assumptions.

Cash and Cash Equivalents

We consider all highly liquid investments with a maturity of three months or less when purchased to be cash equivalents. We maintain deposits primarily in financial institutions, which may at times exceed amounts covered by insurance provided by the U.S. Federal Deposit Insurance Corporation (“FDIC”). We have not experienced any losses related to amounts in excess of FDIC limits.

Short-term Investments

Short-term investments consist of investments in U.S. government, U.S. agency and U.S. treasury securities. We determine the appropriate classification of the securities at the time they are acquired and evaluate the appropriateness of such classifications at each balance sheet date. We classify our short-term investments as available-for-sale pursuant to Accounting Standards Codification (“ASC”) 320, Investments – Debt and Equity Securities. Investments classified as current have maturities of less than one year. We review our short-term investments for other-than-temporary impairment whenever the fair value of a marketable security is less than the amortized cost and evidence indicates that a short-term investment’s carrying amount is not recoverable within a reasonable period of time.

Leases

We account for leases in accordance with ASC 842, Leases. Right-of-use lease assets represent our right to use an underlying asset for the lease term and lease liabilities represent our obligation to make lease payments arising from the lease. The measurement of lease liabilities is based on the present value of future lease payments over the lease term. As our leases do not provide an implicit rate, we use our incremental borrowing rate based on the information available at the lease commencement date in determining the present value of future lease payments. The right-of-use asset is based on the measurement of the lease liability and includes any lease payments made prior to or on lease commencement and excludes lease incentives and initial direct costs incurred, as applicable. Rent expense for our operating leases is recognized on a straight-line basis over the lease term. We do not have any leases classified as finance leases.

Our leases do not have significant rent escalation, holidays, concessions, material residual value guarantees, material restrictive covenants or contingent rent provisions. Our leases include both lease (e.g., fixed payments including rent, taxes, and insurance costs) and non-lease components (e.g., common-area or other maintenance costs), which are accounted for as a single lease component as we have elected the practical expedient to group lease and non-lease components for all leases.

Most leases include one or more options to renew. The exercise of lease renewal options is typically at our sole discretion; therefore, the majority of renewals to extend the lease terms are not included in our right-of-use assets and lease liabilities as they are not reasonably certain of exercise. We regularly evaluate the renewal options and when they are reasonably certain of exercise, we include the renewal period in our lease term.

Additional information and disclosures required under ASC 842 is included in Note 6.

Restricted Cash

In November 2016, the Financial Accounting Standards Board issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash, requiring restricted cash and restricted cash equivalents to be included with cash and cash equivalents on the statement of cash flows when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. We adopted this standard during the first quarter of 2018. Restricted cash is now included as a component of cash, cash equivalents and restricted cash on our consolidated statements of cash flows. Restricted cash is recorded within other assets and restricted cash in the accompanying consolidated balance sheets.

Loss Per Common Share

We have presented basic and diluted loss per common share on the statement of operations. Basic and diluted net loss per share is computed by dividing net loss by the weighted-average number of shares of common stock and shares underlying “pre-funded” warrants outstanding during the period. The “pre-funded” warrants are included in the computation of basic net loss per share as the exercise price is negligible and they are fully vested and exercisable.

| 9 |

We do not include the potential impact of dilutive securities in diluted net loss per share, as the impact of these items is anti-dilutive. Potential dilutive securities result from outstanding stock options and “non-pre-funded” warrants. We did not include the following potentially dilutive securities in the computation of diluted net loss per common share during the periods presented:

| For the three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Warrants | 70,000 | 1,820,686 | ||||||

| Stock options | 6,690,814 | 5,696,353 | ||||||

| Total | 6,760,814 | 7,517,039 | ||||||

NOTE 2 – SHORT-TERM INVESTMENTS

The following table summarizes the available-for-sale investments held:

| Description | March 31, 2020 | December 31, 2019 | ||||||

| U.S. government and agency securities and treasuries | $ | 75,887,000 | $ | - | ||||

The amortized cost of the available-for-sale debt securities, which is adjusted for amortization of premiums and accretion of discounts to maturity, was $75,501,000 as of March 31, 2020. There were no material realized gains or losses recognized on the sale or maturity of available-for-sale debt securities during the three months ended March 31, 2020 or 2019.

NOTE 3 – LICENSED TECHNOLOGY

On November 4, 2018, we entered into a license agreement with REGENXBIO Inc. (“REGENXBIO”) to obtain rights to an exclusive worldwide license (subject to certain non-exclusive rights previously granted for MPS IIIA), with rights to sublicense, to REGENXBIO’s NAV AAV9 vector for gene therapies for treating MPS IIIA, MPS IIIB, CLN1 Disease and CLN3 Disease. Consideration for the rights granted under the original agreement included fees totaling $180 million and a running royalty on net sales, including: (i) an initial fee of $20 million, $10 million of which was due to REGENXBIO shortly after the effective date of the agreement, and $10 million of which was due on the first anniversary of the effective date of the agreement in November 2019, (ii) annual fees totaling $100 million, payable in $20 million annual installments beginning on the second anniversary of the effective date (the first of which remains payable if the agreement is terminated before the second anniversary in November 2020), (iii) sales milestone payments totaling $60 million, and (iv) royalties payable in the low double digits to low teens on net sales of products covered under the agreement. The license is amortized over the life of the patent of eight years. On November 1, 2019, we entered into an amendment of the original license agreement. The amended agreement replaced the $10 million payment due on November 4, 2019 with a $3 million payment due on November 4, 2019 and an additional $8 million payment (which includes $1 million of interest) due no later than April 1, 2020. The payment due by April 1, 2020 and the guaranteed amount of $20 million due on November 4, 2020 are recorded as payable to licensor on the consolidated balance sheet.

Prior to the April 1, 2020 deadline, we engaged REGENXBIO in discussions in an attempt to renegotiate the financial terms of the agreement, but we were unable to reach a mutual understanding that we believed would have been favorable for the Company or our programs, and we did not make the $8 million payment due by April 1, 2020. On April 17, 2020, REGENXBIO sent us a written demand for the $8 million fee, payable within a 15-day cure period after receipt of the demand letter. The license terminated on May 2, 2020, when the 15-day period expired. We are not subject to early termination penalties, but under the agreement, REGENXBIO is still due a total of $28 million.

As of March 31, 2020, we considered the status of our discussions with REGENXBIO as a potential indicator of impairment in accordance with ASC 360-10-35-21. Since our impairment testing indicated that the carrying value of the license agreement exceeded its fair value, we recorded a $32.9 million non-cash impairment charge in the three months ended March 31, 2020.

On May 15, 2015, we acquired Abeona Therapeutics LLC, which had an exclusive license through Nationwide Children’s Hospital to the AB-101 and AB-102 patent portfolios for developing treatments for patients with Sanfilippo Syndrome Type A and Type B. The license is amortized over the life of the license of 20 years.

Licensed technology consists of the following:

March 31, 2020 | December 31, 2019 | |||||||

| Licensed technology | $ | 2,606,000 | $ | 42,606,000 | ||||

| Less accumulated amortization | 638,000 | 6,428,000 | ||||||

| Licensed technology, net | $ | 1,968,000 | $ | 36,178,000 | ||||

| 10 |

The aggregate estimated amortization expense for intangible assets remaining as of March 31, 2020 is as follows:

| 2020, remainder | $ | 130,000 | ||

| 2021 | 174,000 | |||

| 2022 | 174,000 | |||

| 2023 | 174,000 | |||

| 2024 | 174,000 | |||

| Thereafter | 1,142,000 | |||

| Total | $ | 1,968,000 |

Amortization on licensed technology was $1,294,000 and $1,345,000 for the three months ended March 31, 2020 and 2019, respectively.

NOTE 4 – FAIR VALUE MEASUREMENTS

We calculate the fair value of our assets and liabilities that qualify as financial instruments and include additional information in the notes to the consolidated financial statements when the fair value is different than the carrying value of these financial instruments. The estimated fair value of receivables, prepaid expenses, other assets, accounts payable, accrued expenses, payable to licensor and deferred revenue approximate their carrying amounts due to the relatively short maturity of these instruments.

U.S. GAAP defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants at the measurement date. This guidance establishes a three-level fair value hierarchy that prioritizes the inputs used to measure fair value. The hierarchy requires entities to maximize the use of observable inputs and minimize the use of unobservable inputs. The three levels of inputs used to measure fair value are as follows:

| ● | Level 1 – Quoted prices in active markets for identical assets or liabilities. | |

| ● | Level 2 – Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets that are not active; or other inputs that are observable or can be corroborated by observable market data. | |

| ● | Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets and liabilities. This includes certain pricing models, discounted cash flow methodologies and similar valuation techniques that use significant unobservable inputs. |

The guidance requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value.

We have segregated all financial assets and liabilities that are measured at fair value on a recurring basis (at least annually) into the most appropriate level within the fair value hierarchy based on the inputs used to determine the fair value at the measurement date in the table below.

| 11 |

Financial assets and liabilities measured at fair value on a recurring and non-recurring basis as of March 31, 2020 and December 31, 2019 are summarized below:

| Description | March 31, 2020 | Level 1 | Level 2 | Level 3 | ||||||||||||

| Recurring | ||||||||||||||||

| Assets: | ||||||||||||||||

| Short-term investments | $ | 75,887,000 | $ | - | $ | 75,887,000 | $ | - | ||||||||

| Non-recurring | ||||||||||||||||

| Assets: | ||||||||||||||||

| Licensed technology, net | $ | 1,968,000 | $ | - | $ | - | $ | 1,968,000 | ||||||||

| Goodwill | 32,466,000 | - | - | 32,466,000 | ||||||||||||

| Description | December 31, 2019 | Level 1 | Level 2 | Level 3 | ||||||||||||

| Non-recurring | ||||||||||||||||

| Assets: | ||||||||||||||||

| Licensed technology, net | $ | 36,178,000 | $ | - | $ | - | $ | 36,178,000 | ||||||||

| Goodwill | 32,466,000 | - | - | 32,466,000 | ||||||||||||

NOTE 5 – STOCK-BASED COMPENSATION

The following table summarizes stock option-based compensation for the three months ended March 31, 2020 and 2019:

| For the three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Research and development | $ | 744,000 | $ | 1,032,000 | ||||

| General and administrative | 512,000 | 1,071,000 | ||||||

| Stock option-based compensation expense included in operating expense | 1,256,000 | 2,103,000 | ||||||

| Total stock option-based compensation expense | 1,256,000 | 2,103,000 | ||||||

| Tax benefit | - | - | ||||||

| Stock option-based compensation expense, net of tax | $ | 1,256,000 | $ | 2,103,000 | ||||

Stock Options: We estimate the fair value of each option award on the date of grant using the Black-Scholes option valuation model. We then recognize the grant date fair value of each option as compensation expense ratably using the straight-line attribution method over the service period (generally the vesting period). The Black-Scholes model incorporates the following assumptions:

| ● | Expected volatility – we estimate the volatility of our share price at the date of grant using a “look-back” period which coincides with the expected term, defined below. We believe using a “look-back” period which coincides with the expected term is the most appropriate measure for determining expected volatility. | |

| ● | Expected term – we estimate the expected term using the “simplified” method, as outlined in Staff Accounting Bulletin No. 107, “Share-Based Payment.” | |

| ● | Risk-free interest rate – we estimate the risk-free interest rate using the U.S. Treasury yield curve for periods equal to the expected term of the options in effect at the time of grant. | |

| ● | Dividends – we use an expected dividend yield of zero because we have not declared or paid a cash dividend, nor do we have any plans to declare a dividend. |

We used the following weighted-average assumptions to estimate the fair value of the options granted for the periods indicated:

| For the three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Expected volatility | 111 | % | 109 | % | ||||

| Expected term | 6.25 years | 5 years | ||||||

| Risk-free interest rate | 0.43 | % | 2.46 | % | ||||

| Expected dividend yield | 0 | % | 0 | % | ||||

| 12 |

The following table summarizes the options granted for the periods indicated:

| For the three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Options granted | 1,175,927 | 201,000 | ||||||

| Weighted-average: | ||||||||

| Exercise price | $ | 1.45 | $ | 6.69 | ||||

| Grant date fair value | $ | 1.21 | $ | 5.29 | ||||

Restricted Common Stock: We did not grant any shares of restricted common stock to employees during the three months ended March 31, 2020 or 2019. The following table summarizes restricted common stock compensation expense for the three months ended March 31, 2020 and 2019:

| For the three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Research and development | $ | 325,000 | $ | - | ||||

| General and administrative | 139,000 | 172,000 | ||||||

| Restricted stock-based compensation expense included in operating expense | 464,000 | 172,000 | ||||||

| Total restricted stock-based compensation expense | 464,000 | 172,000 | ||||||

| Tax benefit | - | - | ||||||

| Restricted stock-based compensation expense, net of tax | $ | 464,000 | $ | 172,000 | ||||

NOTE 6 – COMMITMENTS AND CONTINGENCIES

Operating Leases

We lease space under operating leases for manufacturing and laboratory facilities and administrative offices in Cleveland, Ohio, as well as administrative offices in New York, New York. We also lease office space in Madrid, Spain as well as certain office equipment under operating leases, which have a non-cancelable lease term of less than one year and therefore, we have elected the practical expedient to exclude these short-term leases from our right-of-use assets and lease liabilities. We can terminate the operating leases for our manufacturing and laboratory facilities and administrative offices in Cleveland early at December 31, 2020 and pay for unamortized tenant improvements.

Components of lease cost are as follows:

| For the three months ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Operating lease cost | $ | 434,000 | $ | 289,000 | ||||

| Variable lease cost | $ | 83,000 | $ | 73,000 | ||||

| Short-term lease cost | $ | 18,000 | $ | 47,000 | ||||

The following table presents information about the amount and timing of cash flows arising from operating leases as of March 31, 2020:

| Maturity of lease liabilities: | ||||

| 2020, remainder | $ | 1,275,000 | ||

| 2021 | 1,713,000 | |||

| 2022 | 1,727,000 | |||

| 2023 | 1,741,000 | |||

| 2024 | 1,781,000 | |||

| Thereafter | 1,885,000 | |||

| Total undiscounted operating lease payments | 10,122,000 | |||

| Less: imputed interest | 2,407,000 | |||

| Present value of operating lease liabilities | $ | 7,715,000 | ||

| Balance sheet classification: | ||||

| Current portion of lease liability | $ | 1,702,000 | ||

| Long-term lease liability | 6,013,000 | |||

| Total operating lease liabilities | $ | 7,715,000 | ||

| Other information: | ||||

| Weighted-average remaining lease term for operating leases | 70 months | |||

| Weighted-average discount rate for operating leases | 9.6 | % | ||

We have engaged a contract manufacturer to assist us with developing and defining the processes necessary to manufacture our RDEB product candidate. We had a remaining commitment of $6.3 million at March 31, 2020. The amount is payable based on the completion of specific activities outlined in the contracted project plan; we expect to spend the entire $6.3 million in 2020.

We are not currently subject to any material pending legal proceedings as of March 31, 2020.

| 13 |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

OVERVIEW

Abeona Therapeutics Inc., a Delaware corporation (together with our subsidiaries, “we,” “our,” “Abeona” or the “Company”), is a clinical-stage biopharmaceutical company developing gene and cell therapies for life-threatening rare genetic diseases. Our lead clinical programs consist of: (i) EB-101, an autologous, gene-corrected cell therapy for recessive dystrophic epidermolysis bullosa (“RDEB”), (ii) ABO-102, an adeno-associated virus (“AAV”)-based gene therapy for Sanfilippo syndrome type A (“MPS IIIA”), and (iii) ABO-101, an AAV-based gene therapy for Sanfilippo syndrome type B (“MPS IIIB”). We have additional AAV-based gene therapies in various developmental stages designed to treat the CLN1 and CLN3 forms of Batten Disease, cystic fibrosis and retinal diseases. Moreover, we are developing next-generation AAV-based gene therapies using our novel AIM™ capsid platform and internal AAV vector research programs. We believe our product candidates are eligible for orphan drug designation, breakthrough therapy designation, or other expedited review processes in the U.S., Europe or Japan. Our pipeline includes five product candidates for which we hold several U.S. and EU regulatory designations:

Our robust and diverse pipeline features early-stage and late-stage candidates with the potential to transform the treatment of devastating genetic diseases, and we are conducting clinical trials in the U.S. and abroad.

Our Mission and Strategy

Abeona is at the forefront of gene and cell therapy research and development. We are a fully integrated company featuring innovative research, therapies in clinical development, in-house manufacturing facilities, a robust pipeline, and scientific, clinical, and commercial leadership. We see our mission as working together to create, develop, manufacture and deliver gene and cell therapies to patients impacted by serious diseases. We partner with leading academic researchers, patient advocacy organizations and caregivers to bring therapies that address the underlying cause of a broad spectrum of rare genetic diseases where no effective treatment options exist today.

| 14 |

Since our last fiscal year, we made significant progress toward fulfilling our goal of harnessing the promise of genetic medicine to transform the lives of people impacted by serious diseases and redefine the standard of care through gene and cell therapies. Our strategy to achieve this goal consists of:

Advancing our Clinical Gene and Cell Therapy Programs and Research and Development with a Focus on Rare and Orphan Diseases.

We have three programs in clinical development—EB-101, ABO-101 and ABO-102—and a pipeline of additional earlier stage programs. Through our gene and cell therapy expertise in research and development, we believe we are positioned to rapidly introduce novel therapeutics to transform the standard of care in devastating diseases and establish our leadership position in the field.

Applying Novel Next Generation AIM™ Capsid Technology to Develop New In-Vivo Gene Therapies.

We are researching and developing next-generation AAV-based gene therapy using our novel capsids developed from the AIM™ Capsid Technology Platform and additional Company-invented AAV capsids. We aim to continue to develop chimeric AAV capsids capable of improved tissue targeting for various indications and potentially evading immunity to wildtype AAV vectors.

Establishing Leadership Position in Commercial-Scale Gene and Cell-Therapy Manufacturing.

We established current Good Manufacturing Practice (“cGMP”), clinical-scale manufacturing capabilities for gene-corrected cell therapy and AAV-based gene therapies in our state-of-the-art Cleveland, OH facility. We believe that our platform provides us with distinct advantages, including flexibility, scale, reliability, and the potential for reduced development risk, cost, and faster times to market. We have focused on establishing internal Chemistry, Manufacturing and Controls (“CMC”) capabilities that drive value for our organization through process development, assay development and manufacturing. We have also deployed robust quality systems governing all aspects of product lifecycle from preclinical through commercial stage.

Establishing Additional Gene and Cell Therapy Franchises and Adjacencies through In-Licensing and Strategic Partnerships.

We seek to be the partner of choice in rare disease and have closely collaborated with leading academic institutions, key opinion leaders, patient foundations and industry partners to generate novel intellectual property, accelerate research and development, and understand the needs of patients and their families.

Maintaining and Growing IP Portfolio.

We strive to have a leading intellectual property portfolio. To that end, we seek patent rights for various aspects of our programs, including vector engineering and construct design, our production process, and all features of our clinical products including composition of matter and method of administration and delivery. We expect to continue to expand our intellectual property portfolio by aggressively seeking patent rights for promising aspects of our product engine and product candidates.

IMPACT OF COVID-19 PANDEMIC ON OUR BUSINESS

The emergence of the coronavirus (“COVID-19”) pandemic has created extraordinary challenges and uncertainty across all aspects of healthcare. We are monitoring the COVID-19 pandemic and its effects and have taken a number of measures to ensure the safety of our patients and employees while sustaining our business operations during this uncertain time. We are fully focused on getting through the pandemic by working closely with our clinical trial sites to ensure that patient safety remains paramount.

We are actively assessing the impact of the COVID-19 pandemic on our business and are taking appropriate actions to manage our spending activities and preserve our cash resources. We will continue to monitor the situation and may take further actions to adjust our business operations that we determine are in the best interests of our patients, employees, suppliers and stockholders. While we are unable to determine or predict the extent, duration or scope of the overall impact the COVID-19 pandemic will have on our business, operations, financial condition or liquidity, we believe that it is important to share where we stand today, how our response to COVID-19 is progressing and how our operations and financial condition may change as the fight against COVID-19 develops.

| 15 |

Clinical Program Activities

We remain committed to advancing our clinical programs, but recognize delays are inevitable in these uncertain times, especially as global healthcare resources are justly redirected to those who need them most. We are continually assessing the dynamic situation and have implemented measures to minimize disruption. We also are regularly reassessing plans along with associated processes and policies to ensure our patients and employees are safe, and that continuity in our scaled back operations remains.

While the full impact on our clinical programs cannot be quantified at this point, all current clinical trial sites remain active, providing virtual and remote follow-up to ensure compliance with safety oversight. Nonetheless, our EB-101 clinical site at Stanford University has paused patient dosing and delays are expected as the situation evolves globally. Clinical sites involved in the studies for children with MPS IIIA and MPS IIIB remain active, but rate of enrollment has slowed due to inability of patients and their families to travel to trial sites.

Manufacturing Activities

Operations at our Cleveland manufacturing facility have been significantly scaled back to ensure that employees and those around them have the best chance to stay safe, and to accommodate reduced manufacturing and clinical development activities. Only employees deemed essential by senior management to maintaining the manufacturing operation are entering the facility under strict safety protocols to mitigate their risk.

We have paused our manufacturing activities for EB-101 material, pending patient enrollment, as well as our AAV manufacturing and process development activities. During this pause period, we are taking the opportunity to complete maintenance and monitoring projects. We are ready to promptly resume our EB-101 manufacturing activities when patients are again ready to be treated in our phase III study as well as our AAV process development and manufacturing activities. We are expecting to resume those activities in the next few weeks but predicated on the evolution of the COVID-19 pandemic.

Business Operations

Looking inward, the safety of our employees is a top priority. We have instituted additional protective measures since news of COVID-19 broke, and we regularly assess and improve our safety practices and policies. Aside from clinical and manufacturing operations, other business operations including regulatory, legal, finance and human resources are less impacted as remote work has continued uninterrupted.

The extent of the impact of the COVID-19 pandemic on our business, operations, and clinical trials will depend on certain developments, including: (i) the duration of the declared health emergencies; (ii) actions being taken by governmental authorities and regulators with respect to the pandemic; (iii) the impact on our partners, collaborators, and suppliers; and (iv) actions being taken by us in response to this crisis. We remain dedicated to communicating regularly and openly with our stakeholders as more information becomes available, including updates on material changes to prior guidance as we continue to follow applicable government, regulatory and institutional guidelines.

RESULTS OF OPERATIONS

Total research and development spending for the first quarter of 2020 was $6.8 million, as compared to $11.7 million for the same period of 2019, a decrease of $4.9 million. The decrease in expenses was primarily due to:

| ● | decreased clinical and development work for our gene and cell therapy product candidates ($4.5 million), partially resulting from scaled back manufacturing, clinical and non-clinical development activities following on from the effects of the COVID-19 pandemic; and | |

| ● | decreased salary and related costs ($0.4 million). |

Total general and administrative expenses were $6.4 million for the first quarter of 2020, as compared to $5.7 million for the same period of 2019, an increase of $0.7 million. The increase in expenses was primarily due to:

| ● | increased salary and related costs ($1.5 million), partially resulting from increased severance costs for certain executive positions; | |

| ● | decreased professional fees ($0.5 million); | |

| ● | decreases in net other general and administrative expenses ($0.3 million). |

Depreciation and amortization were $2.1 million for the first quarter of 2020, as compared to $1.7 million for the same period in 2019, an increase of $0.4 million. The increase was driven primarily by increased depreciation expense on fixed assets.

On November 4, 2018, we entered into a license agreement with REGENXBIO Inc. (“REGENXBIO”) to obtain rights to an exclusive worldwide license (subject to certain non-exclusive rights previously granted for MPS IIIA), with rights to sublicense, to REGENXBIO’s NAV AAV9 vector for gene therapies for treating MPS IIIA, MPS IIIB, CLN1 Disease and CLN3 Disease. The cost of the license was being amortized over the life of the patent of eight years. We had been engaged in recent discussions with REGENXBIO in an attempt to renegotiate the financial terms of the agreement, but we have been unable to reach a mutual understanding that we believed would have been favorable for the Company or our programs, and we did not make an $8 million payment due by April 1, 2020. On April 17, 2020, REGENXBIO sent us a written demand for the $8 million fee, payable within a 15-day cure period after receipt of the demand letter. The license terminated on May 2, 2020, when the 15-day period expired. We are not subject to early termination penalties, but under the Agreement, REGENXBIO is still due a total of $28 million.

As of March 31, 2020, we considered the status of our discussions with REGENXBIO as a potential indicator of impairment in accordance with ASC 360-10-35-21. Since our impairment testing indicated that the carrying value of the license agreement exceeded its fair value, we recorded a $32.9 million non-cash impairment charge in the first quarter of 2020.

| 16 |

Net loss for the first quarter of 2020 was $48.2 million, or a $0.52 basic and diluted loss per common share as compared to a net loss of $18.6 million, or a $0.39 basic and diluted loss per common share, for the same period in 2019. The increase in the net loss results primarily from a licensed technology impairment charge of $32.9 million, partially offset by lower research and development expenses of $4.9 million.

LIQUIDITY AND CAPITAL RESOURCES

We have historically funded our operations primarily through sale of common stock. The COVID-19 pandemic has negatively affected the global economy and created significant volatility and disruption of financial markets. An extended period of economic disruption could negatively affect our business, financial condition, and access to sources of liquidity.

Our principal source of liquidity is cash and cash equivalents. As of March 31, 2020 and December 31, 2019, our cash and cash equivalents were $40.2 million and $129.3 million, respectively.

As of March 31, 2020 and December 31, 2019, our working capital was $82.1 million and $93.7 million, respectively. The decrease in working capital at March 31, 2020 resulted primarily from $13.2 million of cash used for operating activities.

On December 24, 2019, we closed an underwritten public offering of 32,382,945 shares of common stock at a public offering price of $2.50 per share. In addition, as part of the offering, we sold to an existing investor “pre-funded” warrants to purchase up to an aggregate of 9,017,055 shares of common stock at a purchase price of $2.4999 per pre-funded warrant, which equals the public offering price per share of the common stock less the $0.0001 per share exercise price of each pre-funded warrant. The gross proceeds to the Company were approximately $103.5 million, before deducting the underwriting discounts and commissions and estimated offering expenses payable by the Company.

On August 17, 2018, we entered into an open market sale agreement with Jefferies LLC. Pursuant to the terms of this agreement, we may sell from time to time, through Jefferies LLC, shares of our common stock for an aggregate sales price of up to $150 million. Any sales of shares pursuant to this agreement are made under our effective “shelf” registration statement on Form S-3 that is on file with and has been declared effective by the SEC. We did not sell any shares of our common stock under this agreement during the three months ended March 31, 2020.

On November 4, 2018, we entered into a license agreement with REGENXBIO Inc. to obtain rights to an exclusive worldwide license (subject to certain non-exclusive rights previously granted for MPS IIIA), with rights to sublicense, to REGENXBIO’s NAV AAV9 vector for gene therapies for treating MPS IIIA, MPS IIIB, CLN1 Disease and CLN3 Disease. Consideration for the rights granted under the original agreement included fees totaling $180 million and a running royalty on net sales, including: (i) an initial fee of $20 million, $10 million of which was due to REGENXBIO shortly after the effective date of the agreement, and $10 million of which was due on the first anniversary of the effective date of the agreement in November 2019, (ii) annual fees totaling $100 million, payable in $20 million annual installments beginning on the second anniversary of the effective date (the first of which remains payable if the agreement is terminated before the second anniversary in November 2020), (iii) sales milestone payments totaling $60 million, and (iv) royalties payable in the low double digits to low teens on net sales of products covered under the agreement. The license is amortized over the life of the patent of eight years. On November 1, 2019, we entered into an amendment of the original license agreement. The amended agreement replaced the $10 million payment due on November 4, 2019 with a $3 million payment due on November 4, 2019 and an additional $8 million payment (which includes $1 million of interest) due no later than April 1, 2020. The payment due by April 1, 2020 and the guaranteed amount of $20 million due on November 4, 2020 are recorded as payable to licensor on the consolidated balance sheet.

Prior to the April 1, 2020 deadline, we engaged REGENXBIO in discussions in an attempt to renegotiate the financial terms of the agreement, but we were unable to reach a mutual understanding that we believed would have been favorable for the Company or our programs, and we did not make the $8 million payment due by April 1, 2020. On April 17, 2020, REGENXBIO sent us a written demand for the $8 million fee, payable within a 15-day cure period after receipt of the demand letter. The license terminated on May 2, 2020, when the 15-day period expired. We are not subject to early termination penalties, but under the agreement, REGENXBIO is still due a total of $28 million.

Since our inception, we have incurred negative cash flows from operations and have expended, and expect to continue to expend, substantial funds to complete our planned product development efforts. Since inception, our expenses have significantly exceeded revenues, resulting in an accumulated deficit of $534.6 million as of March 31, 2020. We have not been profitable since inception and to date have received limited revenues from the sale of products. We expect to incur losses for the next several years as we continue to invest in product research and development, preclinical studies, clinical trials and regulatory compliance and cannot provide assurance that we will ever be able to generate sufficient product sales or royalty revenue to achieve profitability on a sustained basis, or at all.

| 17 |

If we raise additional funds by selling additional equity securities, the relative equity ownership of our existing investors will be diluted, and the new investors could obtain terms more favorable than previous investors. If we raise additional funds through collaborations, strategic alliances or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs, or product candidates or grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds through equity or debt financing when needed, we may be required to delay, limit or terminate our product development programs or any future commercialization efforts or grant rights to develop and market product candidates to third parties that we would otherwise prefer to develop and market ourselves.

In light of the COVID-19 pandemic, we are carefully re-assessing key business activities and all associated spending decisions while we await clarity on the timing of re-starting our clinical trials and manufacturing activities. When those activities re-start, we expect to spend necessary funds on manufacturing activities and preclinical studies and clinical trials of potential products, including research and development with respect to our acquired and developed technology. Our future capital requirements and adequacy of available funds depend on many factors, including:

| ● | the impact to our business, operations, and clinical programs from the COVID-19 pandemic and related effects on the U.S. and global economy; | |

| ● | the successful development and commercialization of our gene and cell therapy and other product candidates; | |

| ● | the ability to establish and maintain collaborative arrangements with corporate partners for the research, development and commercialization of products; | |

| ● | continued scientific progress in our research and development programs; | |

| ● | the magnitude, scope and results of preclinical testing and clinical trials; | |

| ● | the costs involved in filing, prosecuting and enforcing patent claims; | |

| ● | the costs involved in conducting clinical trials; | |

| ● | competing technological developments; | |

| ● | the cost of manufacturing and scale-up; | |

| ● | the ability to establish and maintain effective commercialization arrangements and activities; and | |

| ● | successful regulatory filings. |

Due to uncertainties and certain of the risks described above, including those relating to the COVID-19 pandemic and our ability to successfully commercialize our product candidates, our ability to obtain applicable regulatory approval to market our product candidates, our ability to obtain necessary additional capital to fund operations in the future, our ability to successfully manufacture our products and our product candidates in clinical quantities or for commercial purposes, government regulation to which we are subject, the uncertainty associated with preclinical and clinical testing, intense competition that we face, market acceptance of our products, the potential necessity of licensing technology from third parties and protection of our intellectual property, it is not possible to reliably predict future spending or time to completion by project or product category or the period in which material net cash inflows from significant projects are expected to commence. If we are unable to timely complete a particular project, our research and development efforts could be delayed or reduced, our business could suffer depending on the significance of the project and we might need to raise additional capital to fund operations, as discussed in the risks above, including those relating to the uncertainty of the success of our research and development activities and our ability to obtain necessary additional capital to fund operations in the future.

We plan to continue our policy of investing any available funds in suitable certificates of deposit, money market funds, government securities and investment-grade, interest-bearing securities. We do not invest in derivative financial instruments.

OFF-BALANCE SHEET ARRANGEMENTS

We did not have, during the periods presented, and we do not currently have, any off-balance sheet arrangements, as defined under applicable SEC rules.

| 18 |

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

Our business and financial results are not materially affected by fluctuations in currency exchange rates or interest rates. We do not use derivative financial instruments for trading or speculative purposes.

Interest Rate Risk

Our exposure to market risk for changes in interest rates is limited to our investment portfolio. Our investment strategy has been focused on preserving capital and supporting our liquidity requirements, while earning a reasonable market return. We invest only in U.S. government, U.S. agency and U.S. treasury securities. The market value of our investments would not materially decline if current market interest rates rise given the short duration of our investments.

Concentrations of Risk

We invest excess cash in short-term, fixed-rate debt securities, and diversify the investments between financial institutions.

Foreign Currency Fluctuation Risk

We are not currently exposed to significant market risk related to changes in foreign currency exchange rates; however, we have contracted with and may continue to contract with foreign vendors that are located in Europe and Australia.

Inflation Fluctuation Risk

Inflation can affect us by increasing our cost of labor and clinical trial costs. We do not believe that inflation had a material effect on our business, financial condition or results of operations during the first quarter of 2020 or 2019.

| ITEM 4. | CONTROLS AND PROCEDURES |

Evaluation of Disclosure Controls and Procedures

Under the supervision and with the participation of our management and consultants, including the Executive Chairman (our principal executive officer) and Chief Accounting Officer (our principal financial officer), we have conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures (“Disclosure Controls and Procedures”), as of March 31, 2020, as such term is defined in Exchange Act Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Conclusion of Evaluation — Based on this Disclosure Controls and Procedures evaluation, the Executive Chairman and Chief Accounting Officer concluded that our Disclosure Controls and Procedures as of March 31, 2020 were effective.

Changes in Internal Control Over Financial Reporting – There were no changes in our internal control over financial reporting that occurred during the quarter ended March 31, 2020 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| 19 |

| ITEM 1. | LEGAL PROCEEDINGS |

Not Applicable.

| ITEM 1A. | RISK FACTORS |

Our business and financial results are subject to numerous risks and uncertainties. As a result, the risks and uncertainties discussed in Part I, Item 1A. Risk Factors in our Form 10-K for the year ended December 31, 2019 should be carefully considered. Aside from the risk factor below, there have been no material changes in the assessment of other risk factors set forth in our 2019 Form 10-K.

The COVID-19 pandemic and efforts to reduce its spread has affected our operations and significantly impacted worldwide economic conditions, and could have a material adverse effect on our operations, business and financial condition.

To date, the COVID-19 pandemic has resulted in extended shutdowns of non-essential businesses throughout Europe and the United States, including in Spain and Australia, where we also conduct operations. The impact of the COVID-19 pandemic is also resulting in social, economic, and labor instability in the countries in which we, or the third parties with whom we engage, operate. Public health officials have recommended precautions to mitigate the spread of the coronavirus, including prohibitions on congregating in heavily populated areas and shelter-in-place orders. As a result, our operations at our Cleveland manufacturing facility have been significantly scaled back to ensure that our employees and those around them have the best chance to remain safe and to accommodate reduced manufacturing and clinical development activities during this uncertain time.

The COVID-19 pandemic has substantially burdened healthcare systems worldwide, delaying enrollment in and progression of many of our clinical trials. Required inspections and reviews by regulatory agencies may also be delayed due to the focus of resources on COVID-19, as well as travel and other restrictions. Significant delays in the timing of our clinical trials and in regulatory reviews could adversely affect our ability to commercialize our product candidates.

Although we remain committed to advancing our clinical programs, we recognize some delays are inevitable in light of the closure of non-essential businesses, stay at home orders, and economic impacts related to the COVID-19 pandemic, especially as healthcare resources are justly redirected to those who need them most. Many of the third parties with whom we engage, including suppliers, clinical trial sites, regulators and other third parties with whom we conduct business, are also experiencing shutdowns or other business disruptions. We may continue to experience disruptions that could severely impact our business, supply chain, manufacturing operations, clinical trials and pre-clinical studies, including:

| ● | continued interruption of key clinical trial activities, including continued limitations on travel imposed or recommended by federal or state governments, employers and others; | |

| ● | continued delays or inability to obtain raw material or ingredients; | |

| ● | continued delays or difficulties in enrolling patients in our clinical trials; | |

| ● | continued delays or difficulties in clinical site initiation, including difficulties in recruiting clinical site investigators and clinical site staff; | |

| ● | delays or difficulties in manufacturing clinical drug material; | |

| ● | continued diversion of healthcare resources away from the conduct of clinical trials, including the diversion of hospitals serving as our clinical trial sites and hospital staff supporting the conduct of our clinical trials; and | |

| ● | continued limitations in employee resources that would otherwise be focused on the conduct of our manufacturing operations, clinical trials and preclinical studies, including because of sickness of employees or their families or the desire of employees to avoid contact with large groups of people. |

The ultimate impact of the COVID-19 pandemic is uncertain and subject to change. We do not yet know the full extent of potential delays or impacts on our business, operations, or financial condition, or on healthcare systems or the global economy as a whole. However, these effects could have a material impact on our ability to access the capital markets as needed and on our operations and business, and those of the third parties on which we rely.

| 20 |

If we fail to comply with our obligations under existing license agreements, the licensor may have the right to terminate such license, in which event we would not be able to develop, manufacture, or market products covered by the license or may face other penalties under the agreements, or cause us to lose our rights under these agreements, including our rights to important intellectual property or technology.

If we fail to comply with our obligations under these license agreements, or we are subject to a bankruptcy, the licensor may have the right to terminate the license, in which event we may face challenges for patent infringement if we continue to develop, manufacture, or market products covered by the license, or may face other penalties under the agreements. Termination of these agreements or reduction or elimination of our rights under these agreements may result in our having to negotiate new or reinstated agreements with less favorable terms or cause us to lose our rights under these agreements, including our rights to important intellectual property or technology.

On May 2, 2020, our license agreement with REGENXBIO to obtain rights to an exclusive worldwide license (subject to certain non-exclusive rights previously granted for MPS IIIA), with rights to sublicense, to REGENXBIO’s NAV AAV9 vector for gene therapies for treating MPS IIIA, MPS IIIB, CLN1 Disease and CLN3 Disease was terminated. The Company had an $8 million payment due on April 1, 2020 pursuant to such agreement. Prior to the April 1, 2020 deadline, the Company engaged REGENXBIO in discussions in an attempt to renegotiate the financial terms of the agreement, but the parties were unable to reach a mutual understanding that the Company believed would have been favorable for the Company or its programs, and the Company did not make the $8 million payment due by April 1, 2020. On April 17, 2020, REGENXBIO sent the Company a written demand for the $8 million fee, payable within a 15-day cure period after receipt of the demand letter. The license terminated on May 2, 2020, when the 15-day period expired. As a result, the Company no longer has an exclusive worldwide license to REGENXBIO’s NAV AAV9 vector for the development and commercialization of gene therapies for the treatment of MPS IIIA, MPS IIIB, CLN1 Disease and CLN3 Disease.

| ITEM 5. | OTHER INFORMATION |

On November 4, 2018, the Company entered into a license agreement (as amended on November 4, 2019, “Agreement”) with REGENXBIO. Under the Agreement, REGENXBIO granted the Company an exclusive worldwide license to use the NAV AAV9 vector for gene therapies for treating Sanfilippo Syndrome Type A (also known as MPS IIIA), Sanfilippo Syndrome Type B (also known as MPS IIIB), Infantile Batten Disease (also known as CLN1 disease) and Juvenile Batten Disease (also known as CLN3 disease).

Consideration for the rights granted under the original Agreement included fees totaling $180 million and a running royalty on net sales, including: (i) an initial fee of $20 million, $10 million of which was due to REGENXBIO shortly after the effective date of the Agreement, and $10 million of which was due on the first anniversary of the effective date of the Agreement in November 2019, (ii) annual fees totaling $100 million, payable in $20 million annual installments beginning on the second anniversary of the effective date (the first of which remains payable if the Agreement is terminated before the second anniversary in November 2020), (iii) sales milestone payments totaling $60 million, and (iv) royalties payable in the low double digits to low teens on net sales of products covered under the Agreement.

As previously reported, on November 4, 2019, the Company and REGENXBIO amended the Agreement to replace the $10 million payment due to REGENXBIO on the first anniversary of the effective date with a provision under which REGENXBIO received $3 million in 2019 and was to receive an additional $8 million no later than April 1, 2020 (including $1 million in interest).

Prior to the April 1, 2020 deadline, the Company engaged REGENXBIO in discussions in an attempt to renegotiate the financial terms of the agreement, but the parties were unable to reach a mutual understanding that the Company believed would have been favorable for the Company or its programs, and the Company did not make the $8 million payment due by April 1, 2020. On April 17, 2020, REGENXBIO sent the Company a written demand for the $8 million fee, payable within a 15-day cure period after receipt of the demand letter. The license terminated on May 2, 2020, when the 15-day period expired. The Company is not subject to early termination penalties, but under the Agreement, REGENXBIO is due a total of $28 million, including one $20 million installment referenced in clause (ii) above, and the $8 million payment that was due on April 1, 2020.

A description of the terms and conditions of the Agreement is set forth under Item 1.01 of the Company’s Current Report on Form 8-K filed with the SEC on November 6, 2018 and is incorporated herein by reference.

| 21 |

| ITEM 6. | EXHIBITS |

See Exhibit Index below, which is incorporated by reference herein.

Exhibit Index

* Pursuant to Item 601(b)(32)(ii) of Regulation S-K, this exhibit shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation language in any filing.

| 22 |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

ABEONA THERAPEUTICS INC. | |||

| Date: | May 6, 2020 | By: | /s/ Brian Pereira |

| Brian Pereira | |||

| Executive Chairman | |||

| (Principal Executive Officer) | |||

| Date: | May 6, 2020 | By: | /s/ Edward Carr |

| Edward Carr | |||

| Chief Accounting Officer | |||

| (Principal Financial Officer) | |||

| 23 |